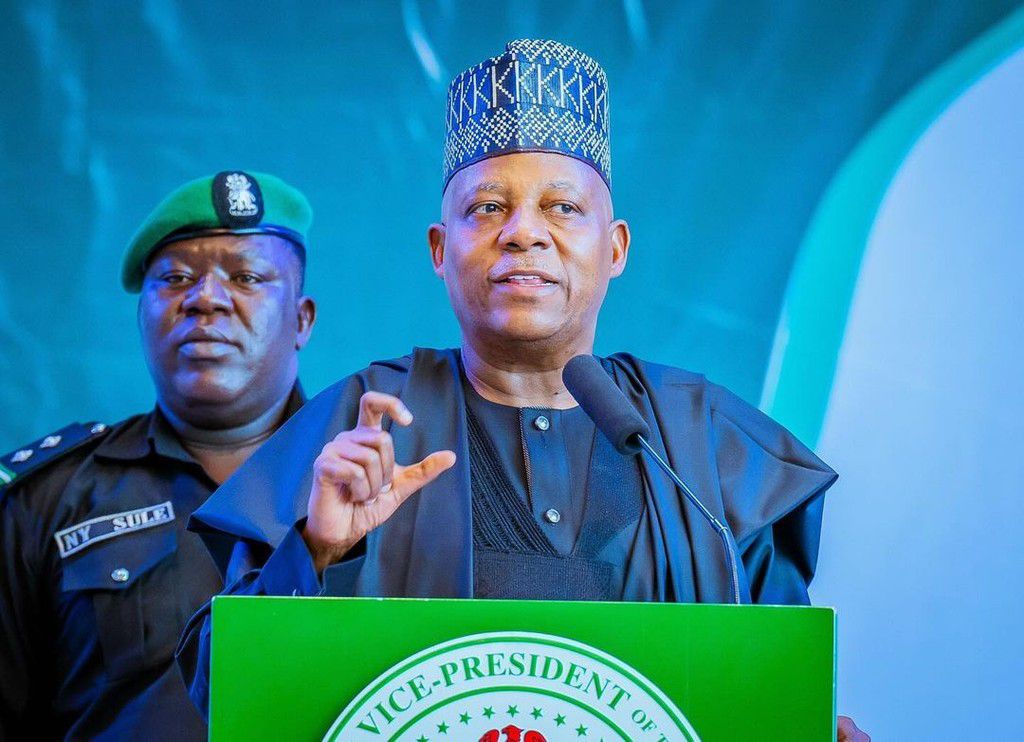

The financial sector in Nigeria is at the heart of public concerns and needs. Availability of local currency liquidity is a major challenge to ensure effective financial inclusion. The Vice President, Senator Kashim Shettima, recently called on Nigerian banks to ensure smooth availability of local currency to the banking public.

Speaking at the Bankers Committee Retreat 2024 in Abuja, represented by Tope Fasua, Special Adviser on Economic Affairs in the Office of the Vice President, Shettima highlighted the importance of addressing some of the non-compliant practices of some Point of Sale (PoS) agents that are hampering access to cash liquidity. This liquidity shortage is a constraint on financial inclusion, a crucial aspect of the country’s economic development.

Nigerian banks play a dominant role in the West African region and beyond, and the development of new initiatives to finance Small and Medium Enterprises (SMEs) is crucial. Shettima stressed the need to support the Federal Government’s efforts in consumer credit culture, thereby encouraging more balanced economic growth.

The Nigerian banking sector has a long tradition of excellence and regional dominance, thus strengthening its position as an economic leader. Current challenges in the financial sector, such as the emergence of Fintechs, Neobanks, cryptocurrencies and decentralized finance, require constant adaptation and effective risk management by banks.

The recent unification of the Naira exchange rate has led to a depreciation of the national currency, changing the behavior of individuals and economic actors. This situation has boosted exports and promoted the development of local industry through increased competitiveness in the international market.

Indeed, the diversification of non-oil exports has enabled Nigeria to record a significant trade surplus and support economic growth. This rebound in non-oil exports contributed to GDP growth, demonstrating the resilience and adaptability of the Nigerian economy in the face of international challenges.

In a constantly changing economic environment, Nigerian banks must continue to innovate and adapt to new dynamics in the financial sector to maximize their contribution to the country’s economic growth. Emphasis on transparency, prudence in risk management and support for local economic development initiatives are key to ensuring sustainable and inclusive growth for the entire population.

In conclusion, the growing demand for local currency liquidity, combined with the challenges and opportunities in the Nigerian financial sector, underscore the need for industry players to work together to address the challenges and seize the opportunities for sustainable economic growth. Political will and stakeholder commitment will be critical to ensuring a prosperous and inclusive future for Nigeria’s economy.